LooksRare Update and Analysis

An overview and analysis of the upcoming $LOOKS rewards cut. Plus... some art, reading, listening.

Hello good humans -

First of all - apologies for being a day late with this Report. Yesterday I awoke to a mysterious, but enticing morning fog. After stretching my legs and enjoying some eggs from the resident fowl fried and tossed over Zolfino beans, I headed out into the Medici woods and completely lost track of time.

By the time I returned home, the sun was low on the horizon, the cypress shadows were stretching and dancing, and I was much more in the mood for wine than for writing. When you live the life of a noble hound, you are afforded the great fortune of being faced with such decisions.

Anyway, today I am trying a slightly new format.

Rather than a long thought piece or an interview, I am going to do an analysis/deep dive on a specific project/token.

Let me know if you like this approach. If you do, perhaps I will do more.

Now, let’s dive in.

This week’s issue of The Monty Report is brought to you by Vault12.

When you buy NFTs and Crypto, you need to make sure they are secure and can easily be passed on to your heirs. But you also want these assets to be available for staking and showcasing.

That’s why Vault12 exists.

Vault12 leverages your trusted personal network - known as Guardians - to help you protect your assets. This innovative solution removes a single point of failure and dramatically reduces risk.

Vault12’s investors include Naval Ravkant, John Callahan, and Cameron & Tyler Winklevoss.

Check out Vault12 and secure your assets today.

Interested in sponsoring The Monty Report? Reply to this email and let’s chat.

LooksRare Rewards Update and Analysis

Sometime next week (the week of May 9th), LooksRare staking and trading rewards will decrease.

Here are some need-to-know details:

Staking Rewards

If you stake $LOOKS, you get rewarded with more $LOOKS. These rewards are called the “staking rewards.”

Currently, each day there are 583,537.50 $LOOKS that are distributed proportionally across all holders of staked $LOOKS (at the time of this writing, $LOOKS is trading at ~$1.70, so this is ~$992,000).

Next week, this will decrease to 230,343.75 $LOOKS/day (~$392,000), which is a decrease of 60.5%.

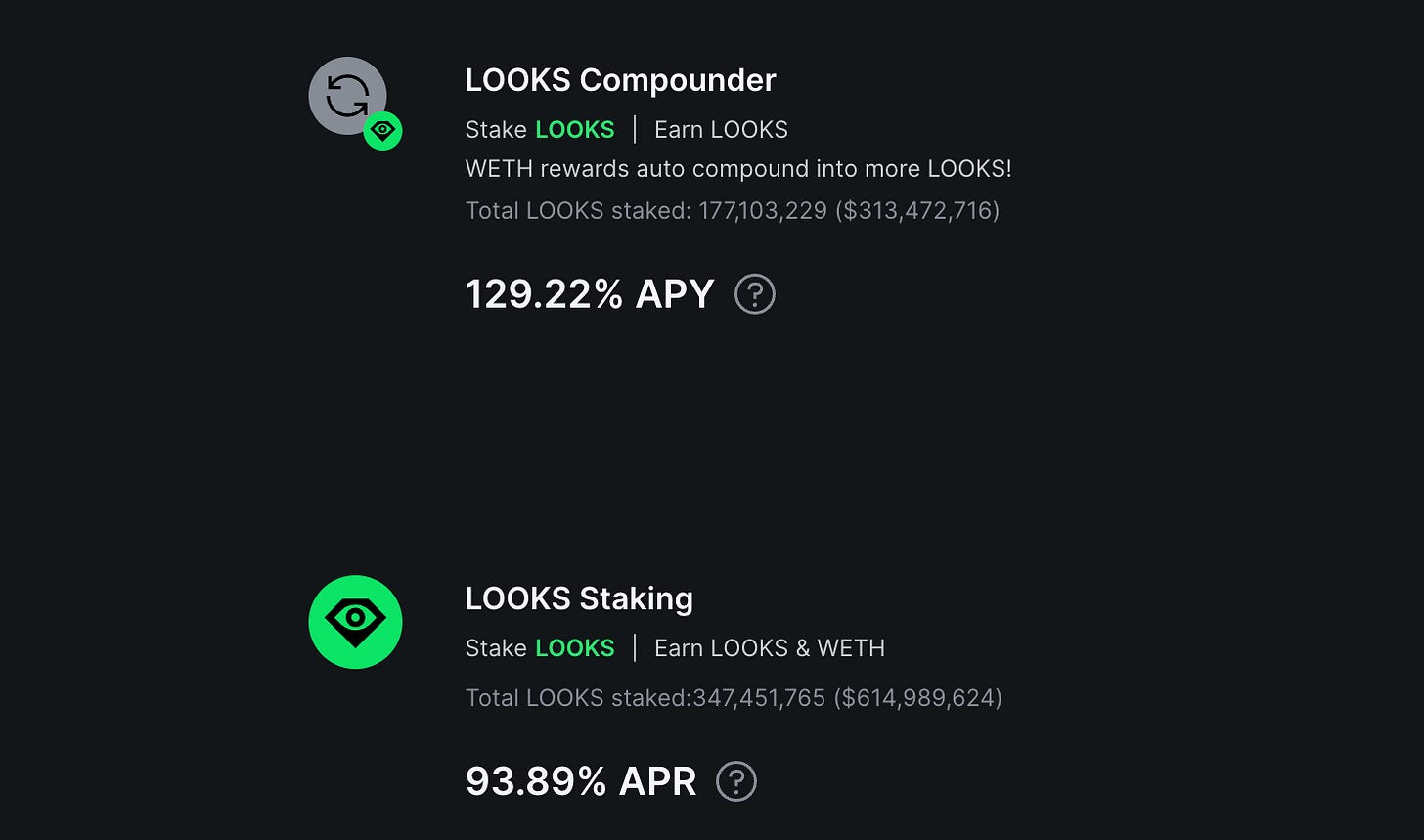

The APR/APY for staking your $LOOKS is currently:

~94% APR for staked $LOOKS

~129% APY if you use the auto compounding feature

(The rate fluctuates based on many different factors)

We will come back to how these rates might change later in this overview because it’s important. But for now, let’s continue with the overview of the facts.

Trading and Listing Rewards

If you trade on LooksRare, you get rewarded with $LOOKS. These rewards are the “Trading Rewards.”

The trading rewards will also diminish next week alongside the staking rewards.

Currently, they are 1,111,587.50 $LOOKS (~$1,190,000) distributed per day to traders (proportionally to your share of trading volume)

It is scheduled to decrease to 537,468.75 $LOOKS/day (~$913,700), which is also 60.5% lower than the current rate.

BUT...in actuality, it will likely be less than this.

Why?

Because a couple of weeks ago the LooksRare team redistributed 250,000 of the daily trading rewards and put them toward rewards for listing NFTs.

With the upcoming decrease in rewards emissions, the LooksRare team hasn't (to my knowledge) commented on what they will do yet with listing rewards.

I could imagine them slashing the listing rewards by the same ratio as the staking and trading rewards (60.5%). In that case:

Listing Rewards will drop to 98,750 $LOOKS/day

Trading Rewards would drop to 438,718 $LOOKS/day

But since they are trying to incentivize listings and organic growth, I could also see them maintaining the 250,000 $LOOKS/day listing reward.

This would mean trading rewards would drop all the way to 287,468 $LOOKS/day, which is only 21% of their current levels.

Whatever the LooksRare team decides to do, it seems like trading rewards will fall to somewhere in the range of 20-40% of their current levels.

This raises an important question: When trading rewards are slashed so significantly, will the wash traders finally disappear?

Enjoying this post?

Subscribe now to get future reports delivered directly to your inbox. New reports are released (almost) every Monday.

If you stumbled across this post and you’re not sure who I am, check out my Twitter, @montymedici, and my archive.

Will the wash traders still have sufficient incentive to trade at 20% - 40% of the previous reward level?

If the numbers don’t make sense for the wash traders, and they do disappear, then we will almost certainly see a decrease in volume on LooksRare.

Why does this matter?

Because LooksRare collects a fee of 2% on all NFT sales (excluding private sales) - this is called the platform fee. And $LOOKS token stakers earn 100% of the platform fee (proportional to their amount of staked LOOKS).

This is the magic that sets LooksRare apart! No matter what happens to $LOOKS, you can still earn cold, hard WETH from platform fees every single day simply by staking your $LOOKS.

Now, as promised, back to the APR.

The total APR for token stakers is made up of two components:

The staking rewards

The platform fee

Currently, the staking rewards make up about ~57% of the total return and the platform fee makes up ~43%.

If trading volume stayed steady, then after the next emissions cuts, we could expect the platform fee to actually make up a larger chunk of the APR than then the staking rewards.

However, because the decrease in trading rewards may cause there to be less volume on the platform, there is a fair amount of uncertainty around what will happen to the platform fee in the coming weeks and months.

Here’s an approximation of the growth of organic volume on LooksRare from this Dune query by @hildobby:

The green is an approximation of organic volume and the black is wash trading. In reality, we don’t exactly know the ratio of organic:wash, but we can approximate it by looking at trades with collections that have a royalty set to 0% since those are the ones that the wash traders use for their trades. In this chart, those trades are represented by the black.

For the past month, the organic volume has averaged 20% of the total volume. But as you can see, it is trending upwards, and it recently had its best day ever.

So in all likelihood, we will see platform fees fall to around 20%-30% of their current levels.

Combined with staking fees falling to 40% of their previous level, we can expect total APR to see a strong decrease.

I won’t speculate on exactly where APR will land since there is so much uncertainty, but it will be a lot less than it is now and a lot more than you get from OpenSea (0%).

So, should $LOOKS stakers be worried about the upcoming rewards cut?

My answer: It depends.

If you are a short-term trader and worried about near-term $LOOKS price action, then possibly. I honestly have no idea. You can read these facts and speculate accordingly.

If you are a long-term investor, then I don’t see much reason to worry. These emissions cuts are just short term noise in a longer-term story that has a lot going for it.

Below are two charts that I think longer-term investors should be excited about (credit again to @hildobby’s LooksRare vs. OpenSea Dune Dashboard).

The first chart shows the LooksRare vs OpenSea market share based on transaction count. I think looking at market share using transaction count makes more sense for LooksRare than using total volume, since so much of the volume at this point is wash trades.

LooksRare is the tiny green section at the bottom of the chart. Look how much open sea there is for LooksRare to expand into!

The second chart zooms in to illustrate the growth in the green area. It is choppy, but it looks like it has really been helped by LooksRare activating listing rewards on April 20th.

Again, even on its best day in the past 2 months, LooksRare only captured 3% of transactions from OpenSea - so much room to grow!

As I’ve said before, habits and behaviors take a long time to change.

The LooksRare team seems genuinely interested in building a world-class Web3 product with staying power. They are responsive, they ship quickly, and most importantly, their interests are aligned with users.

We are fewer than 120 days into LooksRare existence. It is the first half of the first inning.

We will see what happens!

Other notes of interest:

This next rewards phase will be 240 days (approximately 8 months) before the final emissions cut happens right around the 1 year anniversary of the launch of LooksRare

On July 9th (±1 day), there will be a token unlock for investors, the team, and the treasury. This will increase circulating supply by ~10% and may result in some short-term sell pressure from people who haven’t been able to sell since the beginning. You can read more about the tokenonmics here.

You can read all the details of the Rewards system that I coverd in this article here.

If you spot any errors in any of my facts or figures, please reply to this email so that I can correct them!

I own $LOOKS and I am staking them. Nothing in here is financial advice. And as I always say, who takes financial advice from a hound anyway?

🍣 Salmon Bites

A few quick morsels of fun before I sign off:

1. Working on some art!

Inspired by my conversation with Ovie Faruq (AKA OSF), I dusted off the old art supplies!

I take a lottttt of walks around cities all across the world. It’s something I’ve been doing for centuries and it’s one of my favorite activities.

Right now I am thinking about how these walks might serve as the basis for a series….

🐕 🤔

2. Podcast of the Week

I really enjoyed listening to Kevin Rose interview Russian and political activist Nadya Tolokno. Tolonko was a founding member of the anarchist feminist group Pussy Riot, and now she is building UnicornDAO which will invest in female, non-binary, and marginalized artists.

3. Building a Regenerative Economy using the Blockchain

I highly recommend this essay by Packy McCormick from his Not Boring newsletter:

Celo: Building a Regenerative Economy The Carbon-Negative Blockchain Making Money Beautiful

Even if you don’t read it, here’s a quote from the article to get you thinking:

“Whatever backs money, people make more of. When money was backed by cattle, people bred more cattle. When it was backed by gold, people mined more gold.

So why not back money with more of the things that we want to see in the world: clean bodies of water, strong forests, biodiversity?

This is another one of those ideas that seems too idealistic to be possible, until it worms its way into your head.”

And here’s his Twitter thread to go along with it:

Alright, that’s all for now folks!

What did you think about this issue of The Monty Report? Please head over to Twitter and let me know. Be sure to tag me - @MontyMedici - in your post so that I see it.

Until next week.

🐾 🍷

Monty